Posted: 21 November 2023All Peresoft's 2024 Products Released

Peresoft Releases Version 2024

Peresoft Revolutionises Direct Payments and Automates Recon Across Bank Accounts

In its most powerful updates in years, Peresoft is changing the way organisations handle their EFT payments and bank reconciliation, with updates to make accounting simpler, smarter and more automated, as well as slashing time and cost for customers.

Peresoft founder and MD Bobby Perel says the updates, to be released this month, address some of the biggest headaches in accounting today. “Peresoft's new EFT and automated recon products, EFTXpress and RecXpress, take EFT and bank reconciliation to levels previously unheard of in the accounting industry. We’re using intelligent automation to make financial management more efficient, secure, and intuitive. With the latest release, we are eliminating the time-consuming manual work and significant costs involved with EFT payments, and we’re taking bank reconciliations to the next level – eliminating the risk of mistakes across multiple bank accounts,” he says.

Perel believes the updates offer unique benefits, with true automation and improved security, to benefit thousands of local and international Sage 300 Cashbook customers.

Perel believes the updates offer unique benefits, with true automation and improved security, to benefit thousands of local and international Sage 300 Cashbook customers.

The enhancements eliminate the need to share crucial bank login information and save users from having to log into their bank accounts to retrieve statements and post EFT payments.

Perel says: “Unheard of in the Cashbook processing world, you are now able to reconcile unlimited bank accounts with one click. This new feature will let you fetch your bank statement directly from the bank for unlimited bank accounts in one go. This saves the user from having to log into each bank and fetch the statement individually, which can become a very slow and painful task when dealing with more than one bank account. Most companies today have over 10 bank accounts so to be able to fetch the statement from all banks at the same time is a huge time saver."

He explains: "Using one function you can retrieve your bank statements directly from the bank daily, weekly or monthly, not just for one bank at a time but from an unlimited number of banks. Once the program has fetched all the statements you can choose using a date range which month to process. This also allows you to close off your Cashbook whenever you are ready."

"Our new EFT system also lets the user enter their payments directly into their Cashbook product and when you post the batch it will create a file that the bank fetches, processes and sends back a response file that lists which payments were successful and which were rejected. The batch is then processed directly into Cashbook or, if rejected by the bank, creates an error batch that the user can edit and re-post."

"The time saving of this feature is priceless. Processing 50,000 cheques can be a nightmare for our clients but the program does the validation, uploading and posting for the client and finally checking which entries were processed as well, making it error-free and no double entry required. In addition, some banks prefer this type of EFT processing and can charge a lot less in bank charges."

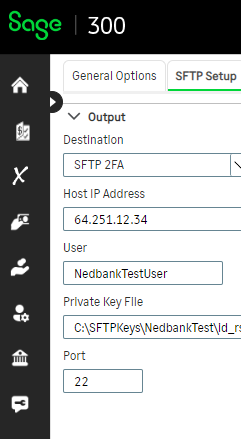

"Because these new features are such a benefit to our thousands of clients, we have decided to make it compatible with many of our previous versions as well. We will not only support our 2024 version but will also support earlier versions of our product. This opens up a door to many of our clients who have expired being able to use these great features," he says. “This feature is now available for Nedbank, Standard Bank and ABSA, with FNB coming on board soon."